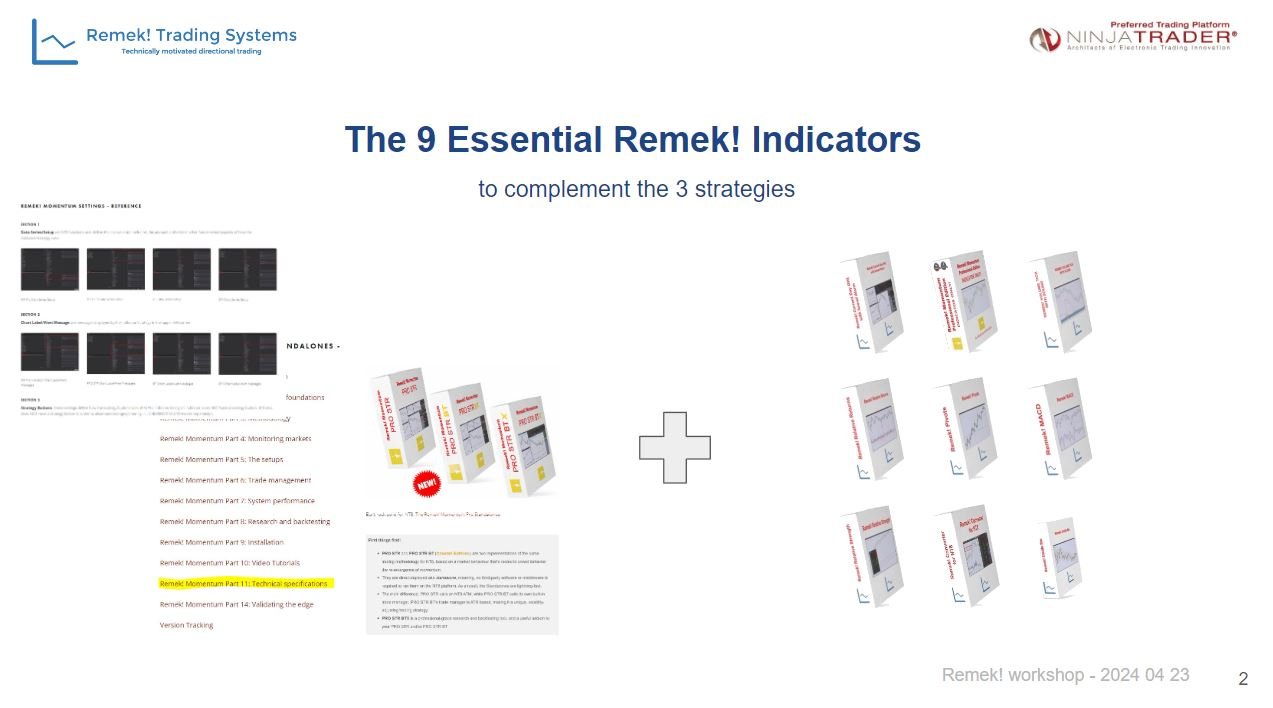

In yesterday’s workshop we reviewed our 9 Essential Remek! Indicators. This time around we provide an easy summary in writing, as seen below, with links to relevant video resources that describe each indicator in detail.

You will find that a careful review and consideration of these indicators, and how they can fit into a given trading process can boost results significantly.

Also note that some of these indicators have been made famous by legendary traders who have worked on platforms other than NT. Thanks to Remek!, these classic indicators are today available to traders on the Ninjatrader platform.

Check these beasts out, and put them to good use: each can be a significant addition to the power already offered by The Remek! Momentum Pro Standalones strategies.

And needless to say, all Remek! indicators are fully compatible with Shark Indicators’ Bloodhound/Blackbird suite, so there’s nothing stopping you if you want to use these tools to build your own trading system!

Remek! Current Day OHL for NT8: especially useful to traders who want to become experts in catching trending days.

Remek! Momentum Pro Indicator: the foundation of our three Standalones strategies.

Remek! VolumeTick with Sound helps identify large player participation on intraday tick charts. Especially useful when used in conjunction with our Remek! Current Day OHL for NT8 indicator.

Remek! Relative Returns (also described here), which closely resembles AHG’s classic SigmaSpike.

Remek! Pivots is a profound educational tool, which helps understand how price action shapes and creates market structure. A must-have indicator for the serious technical trader. (Note: the concept is beautifully described on p. 16 of this classic.)

6. Remek! MACD: the NT8 implementation of Raschke’s classic 3-10 Oscillator, our reliable workhorse to measure momentum. For a deeper study of the concepts behind this indicator, see also p. 409 of the above classic. Used and made famous by two trading legends, this indicator has been available for traders on the NT8 platform, exclusively from Remek!

7. Remek! Relative Strength compares an asset of your choice to a benchmark of your choice, thereby measuring relative strength between two assets. (Note: this indicator is not related to the otherwise useful RSI indicator, which, in fact, has nothing to do with relative strength.) RRS can be extremely useful for making strategic decisions about resourse allocation between asset classes (e.g. equities vs. metals vs. cryptos vs. energies, or between various currencies as compared to the USD).

8. Remek! Converter is a unique powerhouse, which converts volatility (price movement) into dollars, thereby giving an accurate picture of the risks involved when trading various instruments. See also this video for a useful tip. (Note: RC is shown as “USD” in the last column of Remek! Market Scanner Pro in many of our videos)

9. Remek! Inside Bar, as the name suggests, identifies inside bars (and also double inside bars). While the concept of volatility contraction leading to volatility expansion is well-known and the pattern is strong enough to provide an edge, many traders miss too many opportunities. Whether used on the chart or in Remek! Market Scanner Pro, or both, this indicator can help you increase the number of 1R trades coming out of volatility compressions.

Also see our other blogposts about our indicators, as well as our Forum for further discussions. Questions on these indicators? Write to us!